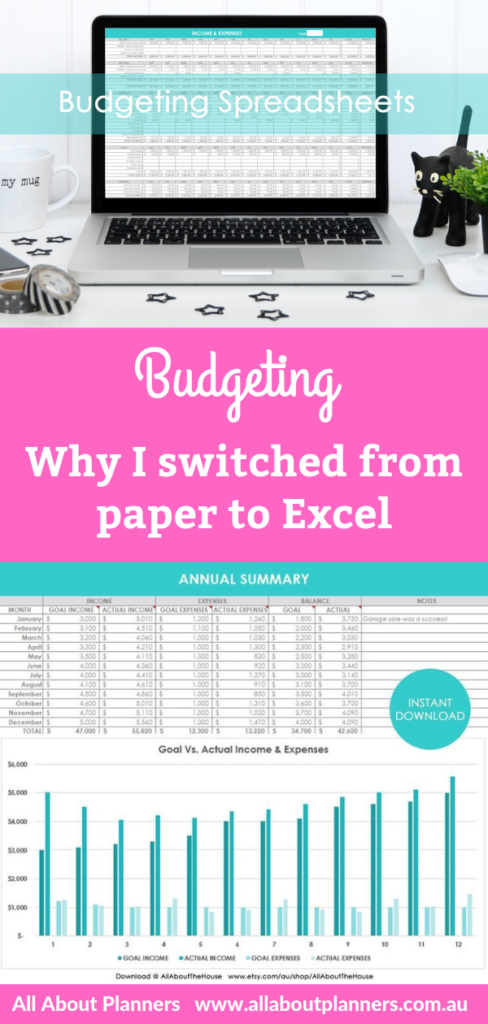

I faithfully used paper for budgeting for many years. I enjoyed using planner stickers and colored pens… but I outgrew it a few years ago, switched to Excel and haven’t looked back!

I did a post back in 2017 about my reasons for the switch and various methods you could use for digital budgeting. But the method that I’ve been using and that I’m sticking to is Excel.

Why I switched to using Excel for budgeting

- Formulas automatically calculate – much quicker than manually adding things up with a calculator

- I can track ALL of my finances in the one place (income, expenses, debt, savings, investments), rather than scattered across multiple pages (previously I was using a monthly calendar, bill tracker, savings tracker etc.)

- Don’t need to re-write the same things each month

- More room to write – you can make the columns and rows as wide as you want

- My handwriting can be messy – in Excel it’s much neater and there’s many different fonts to choose from

- While I can’t use planner stickers and colored pens in Excel, I can use different colored text and shade the cells in different colors

- Excel automatically creates graphs – ideal if you’re a visual person

- Quicker and easier to color code

- Yourself and your partner can easily access the spreadsheet to keep it updated

- If you and your partner both want to update the spreadsheet on the go, you can both access it via Google Sheets (which is a free online tool)

- Easier to forecast budget versus actual

- Easier to pinpoint what areas you’re over budget (I set up my spreadsheets so that the numbers automatically turn red if I’ve gone over budget)

- Can go into plenty of detail and keep it on the same spreadsheet (can zoom in and out in Excel whereas on paper you’re limited by how big you write and how big the piece of paper is)

- Quick to update and formulas will automatically update too

- Can save onto an external harddrive to quickly backup – don’t need to take photos of paper budgets / records for tax records

- Don’t need to store paper

I explain more about why I switched to Excel and show some of the reasons in the video below:

To enlarge the screen of the video, click the square icon in the bottom right hand corner of the video (it will say ‘full screen’ when you hover your mouse over the icon).

Subscribe to my YouTube channel for more planner videos!

Personal Budgeting Spreadsheets

These are the spreadsheets I use for myself. I don’t have a partner or kids so these simple spreadsheets are perfect for my needs!

![]()

If you’d like to try these spreadsheets, there are 9 colors to choose from in my shop:

If you can’t decide on a color I’ve put them together in this bundle:

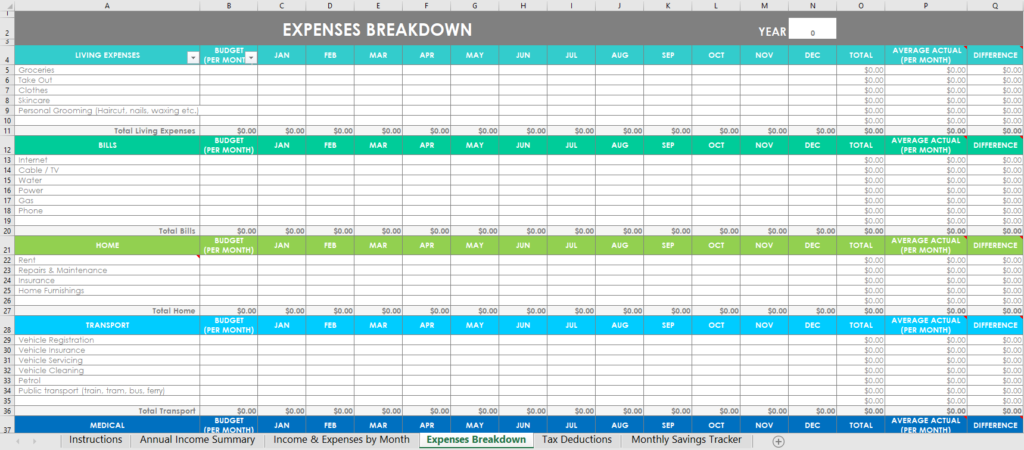

Family Budgeting Spreadsheets

I created these for anyone that has kids. With more people there’s obviously more expenses to track so I added an expenses breakdown tab. The rest of the spreadsheets are the same as my personal budgeting spreadsheets.

I also made a rainbow version if you like color coding 🙂

![]()

Purchase the family budgeting spreadsheets here. Rainbow version available here,

Want to learn how to make your own pretty spreadsheets in Excel? Click here!

Another asset of Excel Spread Sheets is that they can be saved to your Cloud Server. No matter what happens, you can access and download a copy of the last saved version of your spreadsheet. I have had this help me twice, with a large, complex spreadsheet I keep full of vital medical information for my treatment team. Even if your computer is stolen & you wipe it, or it falls in the ocean or burns in a fire, your information is still safe & you can get it back. I do like Excel for it’s ability to track a big picture. Whether it’s vital information or complex financials, it tracks everything, and as you said, can create an incredible range of financial reports, very rapidly. Budgets in hard copy were what I learned in school & it takes a long time and in my day an adding machine to create and fill out all those reports by hand. Calculators came out when I was in College, & made the process much easier. The PC wasn’t created until I was in my mid forties, then came Excel and basic bookkeeping was revolutionized. I can’t sometimes believe how much faster & easier it is now. We can even do taxes on the computer and Excel has all the necessary figures. Plus all the backup is easily saved. You never have to fill out all those extra copies by hand, or even spend time at a copy machine. You can save on a personal drive, a company drive, or into a cloud server. The world of finance is so much faster now. For young people who never had to do all of this by hand on paper, it must be hard to conceive the amount of paper, and hours of work, they don’t have to do. You can even get source documents on line, we used to have to write, request and pay for. Unless someone has the most basic financials, it makes little sense to do it by hand, except as a General learning experience. Thanks for your good and as always practical article on why Excel makes sense for tracking financials.